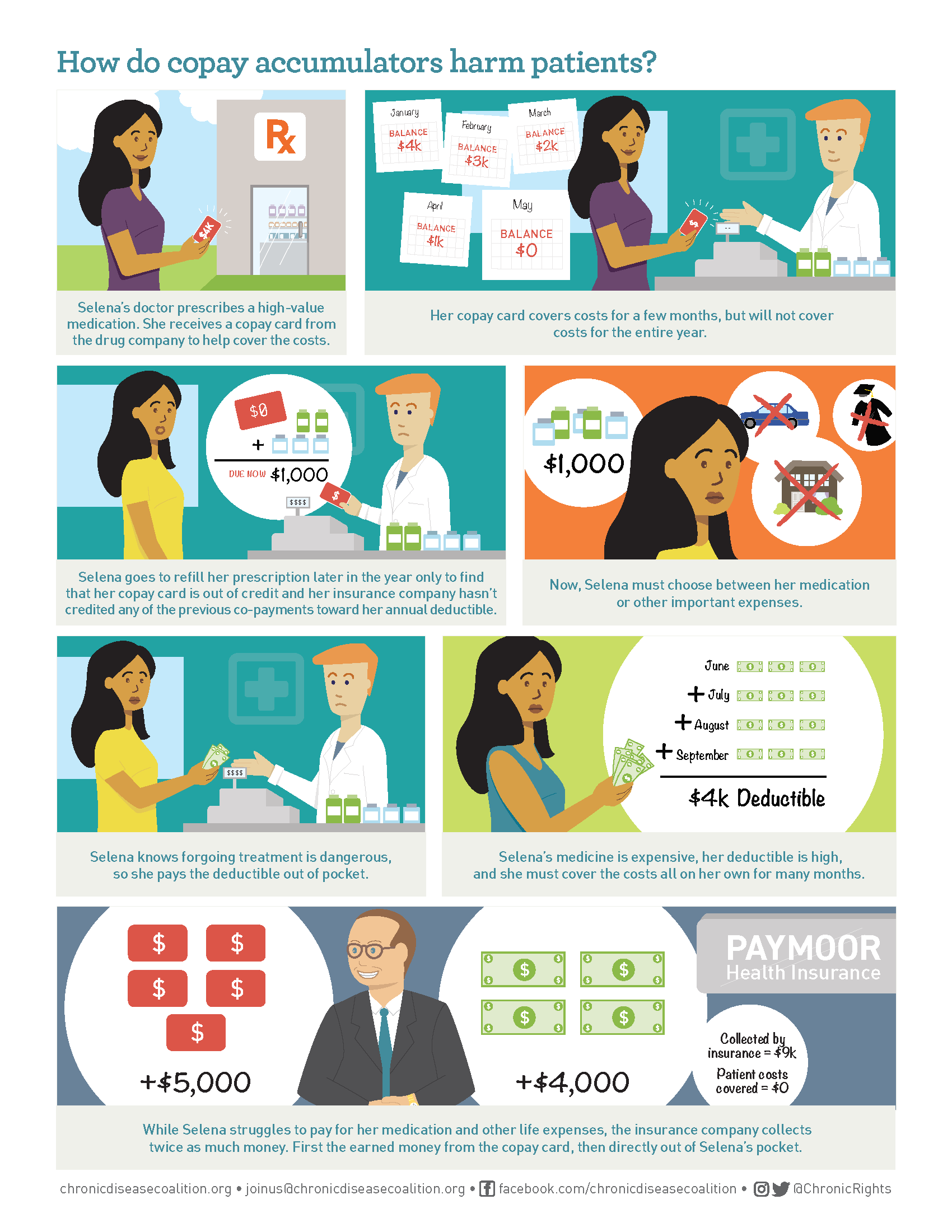

The differences between the two programs can be confusing, but knowing the impacts of accumulator programs and protecting your patient assistance is key:Most commonly, drug manufacturers will provide financial assistance programs by offering what are known as copay coupons or manufacturer copay cards. These cards have a predetermined dollar amount and can sometimes contribute thousands of dollars toward a patient’s medication. Patients pay for medications using their manufacturer benefit card until funds run out. Typically, payments using copay cards count towards the patient’s deductible or out-of-pocket maximum, helping patients afford treatment until insurance benefits begin. Copay accumulator adjustment programs put an end to this by not counting copayments from assistance programs toward a patient’s deductible. Leaving patients with exorbitant out-of-pocket costs after maximizing the assistance they so heavily rely on.

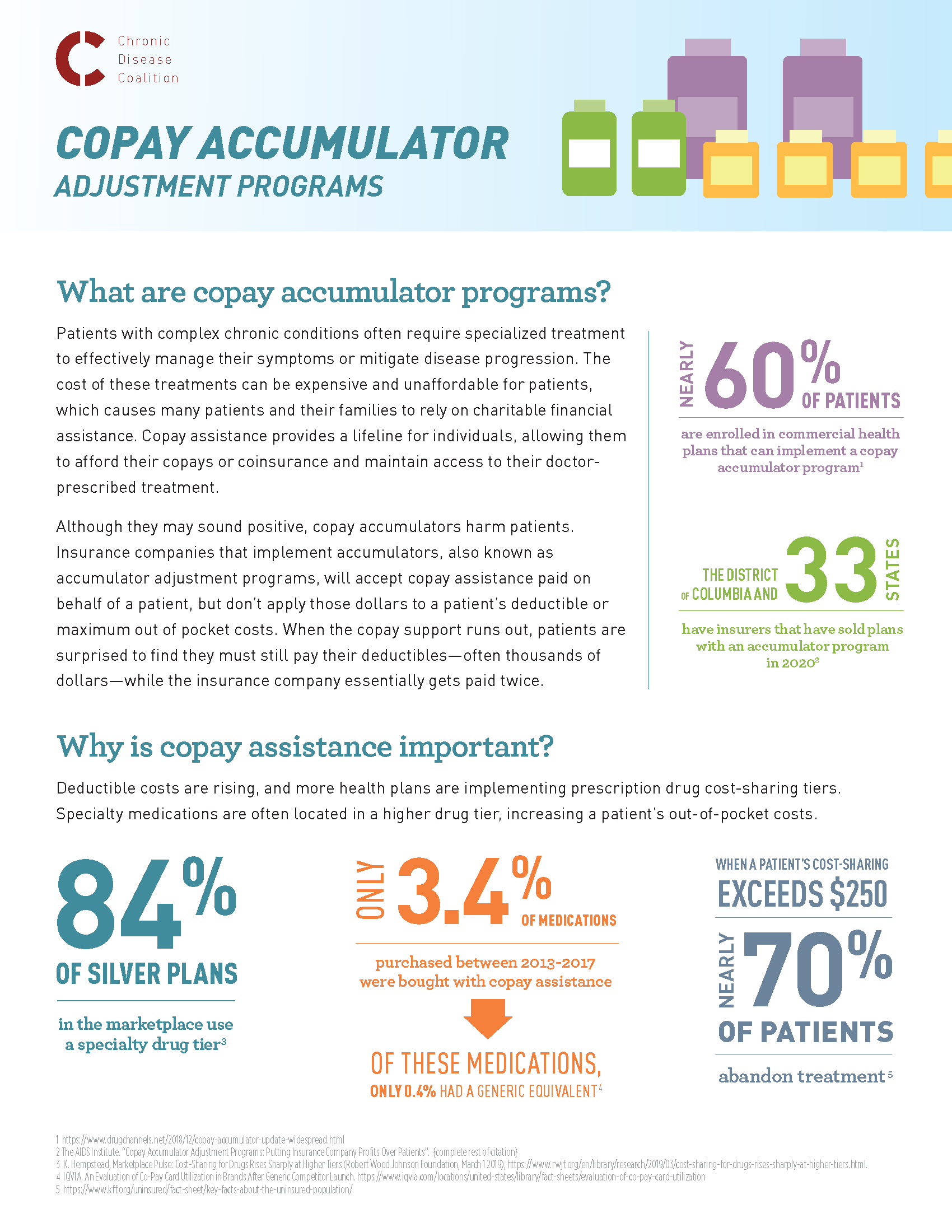

Copay assistance programs are financial relief programs that help patients afford out-of-pocket expenses to cover typically expensive medications or treatments. Copay accumulator programs or accumulator adjustment programs prevent any copayment assistance that may be available for high-cost specialty drugs from counting toward a patient’s deductible or maximum out-of-pocket expenses.

This process essentially forces patients to pay for their treatment twice, first with the funds from their copay card and again once the copay card has been maximized and their deductible has not been met, dramatically reducing the much-needed financial benefit patients receive from copay assistance programs.

Since Spring of 2020 , insurers across the nation have begun implementing accumulator programs in a variety of ways — some requiring patients opt into accumulator programs and others offering it as a supposed benefit.

Only after opting into the program do many patients realize that their copay card or manufacturer benefit card will no longer count towards their yearly deductible. Leaving them with hundreds if not thousands of dollars in out-of-pocket costs mid-year and mid-treatment.

Ensuring patients continue regimented treatment plans can mean the difference between life and death.

In fact, a study from the Kaiser Family Foundation found that nearly 70 percent of patients abandon treatment if their cost-sharing requirement is over $250. Copay accumulator adjustment programs force patients to decide between the cost of treatment and living.

Five states have so far successfully passed legislation that bans accumulator policies—Virginia, West Virginia, Illinois, Arizona and, most recently, Georgia—to help protect patients from high out-of-pocket costs.

Other states are taking a stand across the nation in order to fight back against these dangerous programs including Connecticut, Kentucky, Maryland, Oregon, Indiana and more. Join the CDC in standing up for copay assistance and putting an end to copay accumulators across the nation in 2021.

Visit our website to learn more about copay accumulator programs, send a letter to your local legislator or find easy social content to share with your network. Help us raise awareness around copay accumulators and protect copay assistance!

Check out our fact sheet on copay accumulators and share with your network today!

This process essentially forces patients to pay for their treatment twice, first with the funds from their copay card and again once the copay card has been maximized and their deductible has not been met, dramatically reducing the much-needed financial benefit patients receive from copay assistance programs.

Since Spring of 2020 , insurers across the nation have begun implementing accumulator programs in a variety of ways — some requiring patients opt into accumulator programs and others offering it as a supposed benefit.

Only after opting into the program do many patients realize that their copay card or manufacturer benefit card will no longer count towards their yearly deductible. Leaving them with hundreds if not thousands of dollars in out-of-pocket costs mid-year and mid-treatment.

Ensuring patients continue regimented treatment plans can mean the difference between life and death.

In fact, a study from the Kaiser Family Foundation found that nearly 70 percent of patients abandon treatment if their cost-sharing requirement is over $250. Copay accumulator adjustment programs force patients to decide between the cost of treatment and living.

Five states have so far successfully passed legislation that bans accumulator policies—Virginia, West Virginia, Illinois, Arizona and, most recently, Georgia—to help protect patients from high out-of-pocket costs.

Other states are taking a stand across the nation in order to fight back against these dangerous programs including Connecticut, Kentucky, Maryland, Oregon, Indiana and more. Join the CDC in standing up for copay assistance and putting an end to copay accumulators across the nation in 2021.

Visit our website to learn more about copay accumulator programs, send a letter to your local legislator or find easy social content to share with your network. Help us raise awareness around copay accumulators and protect copay assistance!

Check out our fact sheet on copay accumulators and share with your network today!

|

|